will county illinois property tax due dates 2021

In Cook County the first installment is due by March 1. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of.

The balance is calculated by subtracting the first installment from the total taxes due for the present year.

. In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes. Will County collects on average 205 of a propertys assessed fair market value as property tax. Founded in 1836 today Will County is a major hub for roads rail and natural gas pipelines.

December 17 2021 tallment additional 15 every 30 days Last day to pay property taxes with December 23 2021 a personal check Must be cash cashier check or money order after this date December 21 2021 Delinquent Certified Letters Mailed January 14 2022 Publication cut off date. The Countys property tax offices recently announced an extended due date until October 1st. Tax Year 2020 Second Installment Due Date.

Will County Treasurer Tim Brophy said the board should establish June 3 Aug. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. Will County Il Property Tax Due Dates 2022.

Property tax bills mailed. Late Payment Interest Waived through Monday May 3 2021. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are usually due in August the due date was postponed until October 1st.

Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes. Last day to pay property taxes without the 1000 publication fee. Due dates will be as follows.

Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due. Tuesday March 1 2022. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted.

It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents. Interest will begin accruing June 2 2022 d due dates will be as follows 1st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 1. December 18 2021 Only cashier checkmoney orders accepted for payment.

Publicado en mayo 29 2021 por mayo 29 2021 por. Half of the First Installment is due by June 3 2021. Tax Year 2021 First Installment Due Date.

Deadline to pay taxes in office. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. December 23 2021 Tax Buyer registration deadline.

First payment due in June 2022. The state average is lower at 173. View 2021 Taxes payable in 2022 View 2020 Taxes payable in 2021.

Property taxesthey can feel like a burden especially in areas with high rates including Will County. January 7 2022 430 pm. Will County is located in the northern part of Illinois and is one of the fastest-growing counties in the United States.

The county seat of Will County is Joliet. Deadline to pay taxes on-line. The exact property tax levied depends on the county in Illinois the property is located in.

This installment is mailed by January 31. Certified funds or cash only. Uncategorized will county property tax due dates 2021.

Tuesday March 2 2021. Friday October 1 2021. Even if youve lived in the same area for years you may notice that your rates fluctuate.

December 17 2021 430 pm. Last day to submit changes for ACH withdrawals for. 3 as the due dates for 2021.

My name andor mailing address is wrong on my tax bill. Will County property tax due dates 2021. The property tax rate in Will County Illinois is 205 costing residents an average of 4921 per year.

Post-mark accepted 5 per month. The remaining half of the First Installment is due by August 3 2021. 2021 Real Estate Tax Calendar payable in 2022 May 2nd.

Tax Year 2020 First Installment Due Date.

Cook County Property Tax Bills Will Be Late Next Year Chicago Sun Times

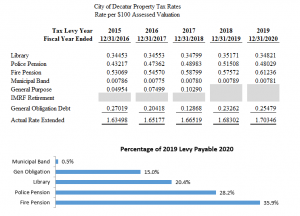

Property Tax City Of Decatur Il

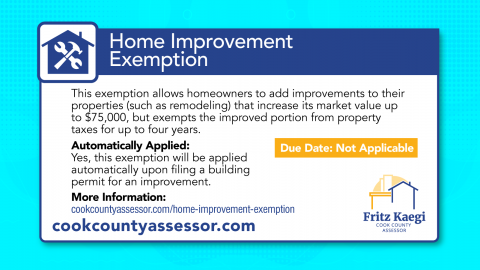

Home Improvement Exemption Cook County Assessor S Office

Property Tax Bills In Winnebago County Have Been Mailed Out Partial Payments To Be Accepted News Wrex Com

Location Information Will County Center For Economic Development Ced

What Cook County Township Am I In Kensington Research

Cook County Treasurer S Office Chicago Illinois

Cook County First Installment Property Tax Bills Due March 1 2022 Village Of Barrington Hills

The Cook County Property Tax System Cook County Assessor S Office

First Installment Of 2021 Cook County Property Taxes Available Online Chicago Association Of Realtors

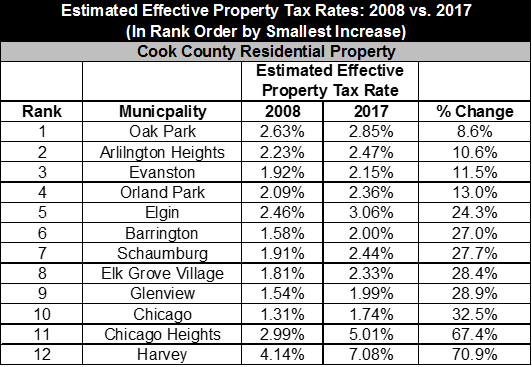

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

The Cook County Property Tax System Cook County Assessor S Office