cap and trade vs carbon tax upsc

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas. April 9 2007 413 pm ET.

Carbon Tax Or Cap And Trade David Suzuki Foundation

With a cap you get the inverse.

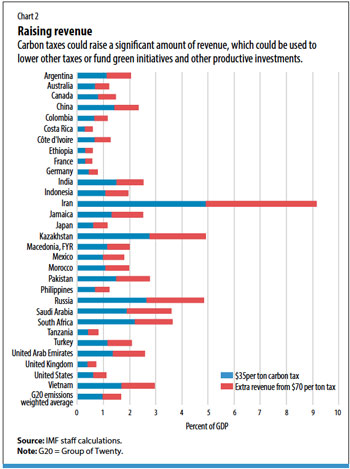

. However experts are divided on the question of which of the two main types of carbon pricing carbon tax and cap-and-trade works best. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases.

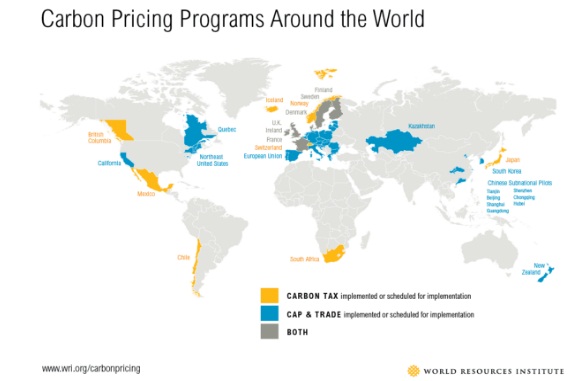

A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. In contrast cap and trade levies an implicit tax on carbon. It goes on and on and on and it never changes.

The revenue generated from the taxation will also assist Canadians by. Carbon taxes vs. In 2015 it was further increased to Rs 200.

A carbon tax and cap-and-trade are opposite sides of the same coin. With cap-and-trade units of carbon are initially given out for free. I find it really hard to believe but the perennial carbon tax vs.

At the same time the economys performance affects the. Cap and Trade have one environmental advantage over Carbon tax as it provides more certainty about the number of emission reductions that will lead to a little less certainty. A carbon tax is an explicit tax and Americans are notoriously tax phobic.

Cap-and-trade debate is still going on. In 2014 it was increased to Rs 100. Carbon Tax India.

A carbon tax system as the. The combination of an absolute cap on the level of emissions permitted and the carbon price signal from trading. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

Each approach has its vocal supporters. India imposed a Carbon tax of Rs 50 per ton of coal produced and imported in 2010. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions.

A centrally-administered tax does not have the same flexibility. Carbon Tax vs Cap-and-Trade. With a tax you get certainty about prices but uncertainty about emission reductions.

This can be implemented either through. If the European Unions Emission Trading Scheme. As well with the carbon tax system there is more motivation to adhere to regulations because it will become a standard.

It provides more certainty about the amount of emissions reductions that will result and little certainty about the price. You can tweak a tax to shift the balance. Carbon Tax vs.

Those in favor of cap and trade. Theory and practice Robert N. Cap-and-trade has one key environmental advantage over a carbon tax.

Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. The impact of the carbon tax and cap-and-trade on a countrys economy is significant. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of.

27 Main Pros Cons Of Carbon Taxes E C

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Cap And Trade Vs Carbon Tax Youtube

Carbon Pricing Types Pros And Cons Of Carbon Tax For Upsc Exam

Difference Between Carbon Tax And Cap And Trade Youtube

Carbon Fee And Dividend Wikipedia

Upsc Prelims 2019 Answer Key Analysis Drishti Ias

Unfccc Kyoto Protocol Unfccc Summit 1997 Carbon Trading Pmf Ias

Pricing Carbon A Carbon Tax Or Cap And Trade

The Case For Carbon Taxation Imf F D December 2019

Cop25 Longest Climate Talks End Iasbaba

Iasbaba S Daily Current Affairs 16th May 2017 Iasbaba

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal India S Largest Community For Upsc Exam Aspirants

Carbon Tax Vs Cap And Trade Vs Carbon Credit Vs Carbon Pricing Difference 1 2 Youtube

A Clean Innovation Comparison Between Carbon Tax And Cap And Trade System Sciencedirect

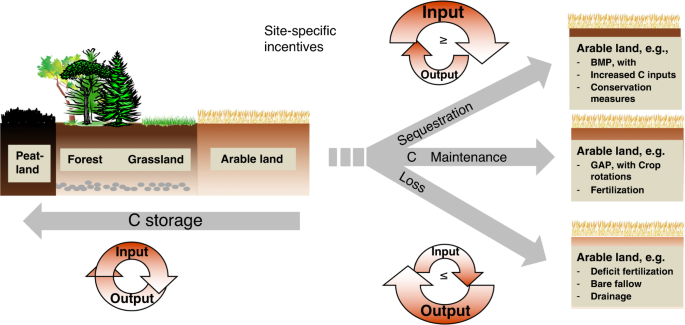

Towards A Global Scale Soil Climate Mitigation Strategy Nature Communications